Why, shareholders have asked, doesn’t Berkshire Hathaway pay dividends? In 2012, Warren Buffett’s letter to shareholders addressed the question of dividends head on.

He laid out his reasoning through a hypothetical example. Imagine that you and I, he wrote, are equal owners of a business that’s worth $2 million. And imagine that it can earn a 12 percent return—or $240,000—each year.

You want income and propose that each year our company invests two-thirds of those earnings in growth, while paying out a third of its earnings in dividends—a nice little check of $40,000 for each of us in the first year, growing over time as the value of the company continues to increase. Sounds good, right?

But then, Buffett asks, consider an alternative: reinvest all our company’s earnings in growth and sell 3.2 percent of our shares each year. He called this a “sell-off” approach. The first year’s check would be the same $40,000. But the company will grow a third faster with each passing year. Look out ten years, he argued; the result is an even bigger win-win. The value of your shares would be higher, and your annual payouts would be higher too. “Voila!” Buffett wrote. “You would have both more cash to spend and more capital value.”

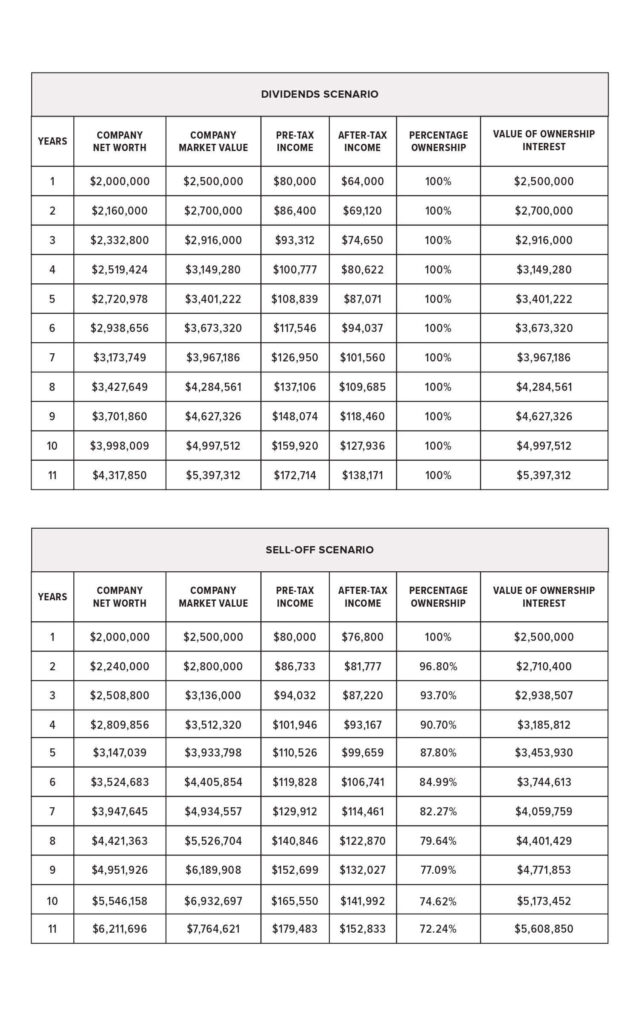

Below is a visualization of his example with a couple adjustments. For simplicity, it combines the two owners into one owner. And I added two assumptions: first, since the business has a net worth of $2 million, I assumed a cost basis of $2 million. Second, I assumed a tax rate of 20 percent. I assumed 20 percent because most dividends are recognized as ‘qualified’ dividends and fall under the tax schedule of long-term capital gains. Under that schedule, it’s common for investors to pay a 15 percent federal tax rate plus their applicable state tax rate.

The following table has two parts – a dividends scenario and a “sell-off” scenario. I want you to notice two important facts. First, in the sell-off scenario, the owner ends up with 72 percent ownership in the company, but this portion is still worth more than owning the entire “dividend company.” You can view that comparison in the far-right column. Second, notice how income from selling shares is higher than income from dividends every year, and significantly higher when taxes are factored in. You can view this in the center-columns.

In the dividend scenario over ten years, dividends produced pretax income of $1,158,925. After 20 percent taxes are applied, this leaves after-tax income of $927,140.

In the sell-off scenario over ten years, share sales produced pretax income of $1,182,072. After 20 percent taxes are applied to the gain portion of sales, this leaves after-tax income of $1,209,547.

The sell-off strategy first produced an additional $23,147 of income, and second saved a whopping $282,407 in taxes over ten years. What would you do with that kind of tax savings?

By using the sell-off strategy in this example, the owner’s effective tax rate is nearly cut in half, from 20 percent to 10.6 percent! Moreover, the owner enjoys greater growth of principal and greater income.

Buffett’s lesson to Berkshire shareholders clearly worked. A few years ago, a Berkshire Hathaway shareholder put forward a proposal for a vote on paying a dividend. He allowed the vote to occur. The result was as close to a communist election tally as you can come in an actual, fair, straight-up vote: shareholders voted 98 percent in favor of no dividend.

Want to learn more about how to gain peace of mind with your investments?

Check out my book Income on Demand on Amazon to build your financial castle.

Contact Us to learn more about how Farnam Financial can help you achieve your goals.

Jonathan Bird, CFP®

Farnam Financial LLC (“Farnam”) is a registered investment advisor offering advisory services in the State of Arizona and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Farnam in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Farnam, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to other parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.