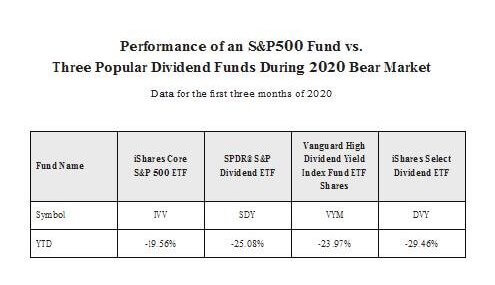

You might wonder, does dividend investing help protect me on the downside versus owning a slice of the general stock market? The Covid-19 pandemic brought a bear market that shows us. A bear market means a drop 20% or more in price. In the chart below, notice how the S&P 500 fund and three popular dividend funds performed in the first three months of 2020. Spoiler alert, the S&P 500 performed better than the popular dividend funds:

Why did this happen? Stock prices tend to move in tandem with business fundamentals. Several non-dividend or low-dividend stocks during the bear-market actually improved their fundamentals and therefore their stocks performed better. Companies like Amazon, Netflix, and Facebook saw an increase in customer usage and sales. These stocks don’t pay dividends and their inclusion in the S&P 500 helped ensure it outperformed many popular dividend companies and funds.

Want to learn more about benefits of the Income on Demand strategy including protecting your principal during a bear market?

Check out my book Income on Demand on Amazon to build your financial castle.

Contact Us to learn more about how Farnam Financial can help you achieve your goals.

Jonathan Bird, CFP®

Farnam Financial LLC (“Farnam”) is a registered investment advisor offering advisory services in the State of Arizona and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Farnam in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Farnam, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to other parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.