“Well-managed industrial companies do not, as a rule, distribute to the shareholders the whole of their earned profits,” wrote John Maynard Keynes, one of the foremost economists of the twentieth century. “In good years, if not in all years, they retain a part of their profits and put them back into the business. Thus there is an element of compound interest operating in favor of a sound industrial development.” Keynes is not referring to reinvesting dividends—an activity that puts a tax liability on shareholders. He’s referring to retained profits, money earned by the company and retained in the company—an activity that does not put any tax liability on shareholders.

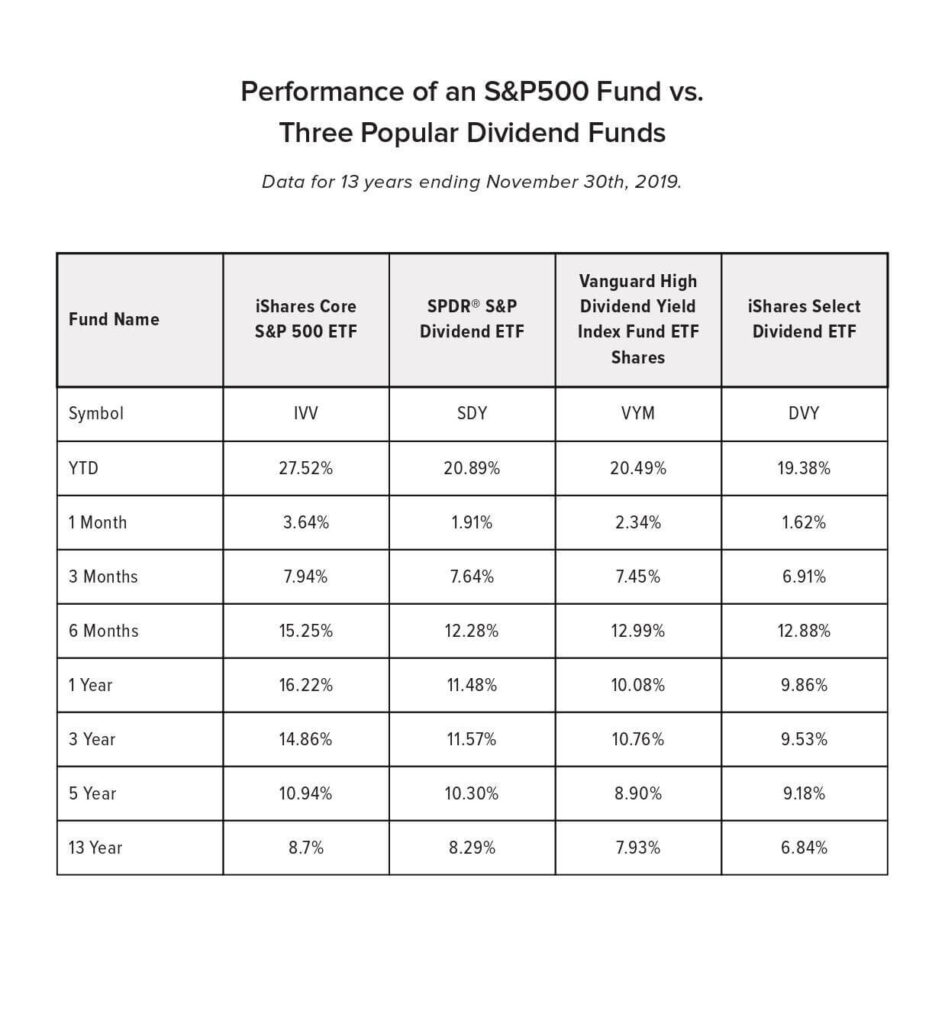

The numbers support what strikes me as common sense. Consider the accompanying chart. If you had invested $100,000 in a low-cost S&P 500 ETF fund—an approximation of the overall market—in 2007, you’d have had nearly $296,000 by November of 2019. If you’d put the same sum in one of the three popular dividend-based funds, you’d have as much as $60,000 less. Remember, you’re not losing out on dividends altogether when you invest in the overall market. The point is that an index fund has the potential to offer better total return—how much you receive in income plus price appreciation. The table below illustrates the returns of a low-cost S&P 500 index fund versus three popular dividend ETFs. Each column represents a fund, and the return figures below it represent the performance over a specific time period.

Want to learn more about a retirement income strategy that helps minimize your tax bill and helps improve your returns?

Check out my book Income on Demand on Amazon to build your financial castle.

Contact Us to learn more about how Farnam Financial can help you achieve your goals.

Jonathan Bird, CFP®

Farnam Financial LLC (“Farnam”) is a registered investment advisor offering advisory services in the State of Arizona and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Farnam in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Farnam, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to other parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.