“Dear Mr. Schwab,

The progress of the Schwab Corporation over the past four decades has been nothing short of phenomenal. I’ve read through the history of the company and found that after we went public, stockholders looked to balance the need for current income with capital growth. Since 1989 the dividend payout has been rising at a commensurate rate with earnings growth and the ending result has been wonderful. I want to acknowledge the need for stockholders to continue increasing their income from the business over time, but I wish to suggest that continuing to raise the quarterly dividend represents only the company’s second-best option for achieving that end. I am writing because I want to share with you a strategy that allows yourself and all stockholders to increase income from the business in a more tax-advantageous way.”

That’s how I began my letter to Chuck Schwab, outlining the case for change at his company based on the principles I’ve described in the Income On Demand book. I went on to show Chuck how taking, say, an additional $5 million in income from selling price-appreciated shares rather than taking additional dividends would save him $333,000 a year in taxes. I also described how all shareholders could benefit from adopting this income-on-demand approach. I argued that money invested in the Schwab company itself rather than paid out in dividends would accelerate the company’s growth. And I was realistic. I didn’t argue that we should stop paying dividends; instead, I said, we should simply stop increasing them.

“This move is not just in your best interest or the company’s best interest,” I closed. “Because of how well it capitalizes and sets Schwab up for continued growth and innovation, it’s most importantly in the best interest of our clients.”

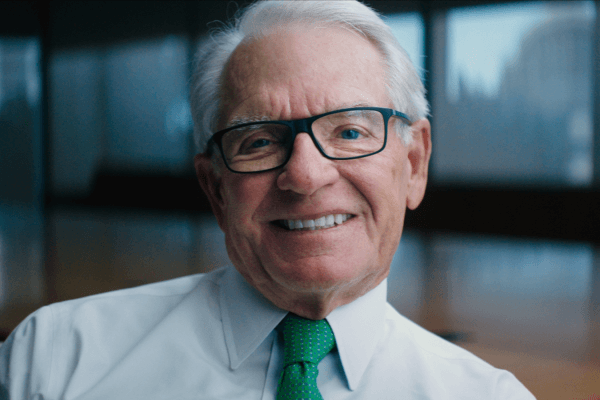

The letter made an impact. Chuck invited me to his office to discuss it. In October of 2018, I met him on the top floor of Schwab headquarters in San Francisco. He has the plushest carpet I’ve ever stood on, so thick and soft I felt like I was walking on a cloud. “Nice to meet you, Jonathan,” Chuck said as he shook my hand. “Why don’t you come sit down and you can win me over on your proposal?” Greg Gable, his chief of staff, joined us.

At this point, Chuck was eighty-one years old. I was thirty. He had founded a company that pioneered discount stock sales back in 1975, and brought trading commissions to $0 by 2019. At the time we met, the company bearing his name employed fourteen thousand people and maintained ten million client accounts. His net worth stood above $8 billion.

Chuck was warm, welcoming, and curious about my background and my work with the company. Greg complimented the income strategy case I made, saying it would allow shareholders to take income on their terms, which aligned well with the company’s core commitment to “serve clients on their terms.” But when the conversation turned to my proposal, Chuck didn’t ask me to expand on what I’d written.

“I agree with you that financially we would be better off if we did this,” he said. My eyes widened – maybe this would be the start of a much larger conversation. “But there are important non-financial reasons why we’re not going to do it.” He explained that, as a financial services company, the market expected Schwab to pay a dividend. Paying dividends, he added, also helps Schwab broaden its investor base. A broader base, he said, helped protect the company from a takeover and the culture change that could come with it. And finally he added, “If we use this strategy, you’re right, it’s going to minimize the taxes that we pay, but we don’t want to minimize our taxes too much.”

I felt I could read between the lines of what he was saying. I realized he simply didn’t want to change.

The Charles Schwab Corporation has its reasons for maintaining its dividend policy. More importantly though, Chuck Schwab had acknowledged the potential benefits of the Income-on-Demand strategy, and I left that meeting every bit as convinced that there was a better way for individuals like you to generate income.

Want to learn more about the benefits of the Income on Demand strategy?

These benefits include helping lower your tax bill, improving your returns, and gaining financial peace of mind.

Check out my book Income on Demand on Amazon to build your financial castle.

Contact Us to learn more about how Farnam Financial can help you achieve your goals.

Jonathan Bird, CFP®

Farnam Financial LLC (“Farnam”) is a registered investment advisor offering advisory services in the State of Arizona and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Farnam in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Farnam, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to other parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.